An Integrated Electricity Market Model

11.18

From 2011 to 2012

TML developed a comparative static model of the electricity markets of seven EU member states, focusing on cross-border connections. This model, based on the Cournot approach, allows users to perform oligopolistic welfare analyses and take into account variables such as fuel prices, renewable energy support, and emission limits.

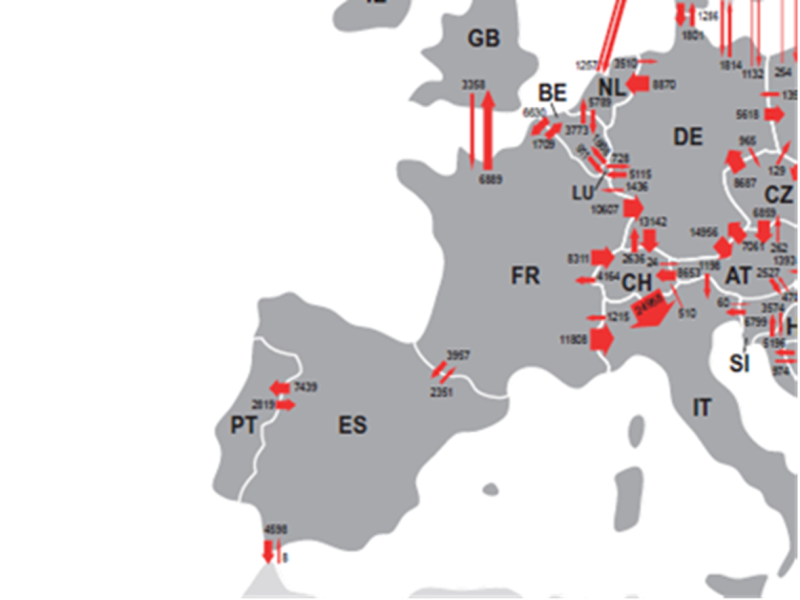

This research project for the European Commission's DG JRC-IPTS developed a comparative static model of the electricity markets of seven EU Member States (Portugal, Spain, France, Germany, Belgium, the Netherlands, and Luxembourg). It considered cross-border connections between these countries.

The model can be used to perform oligopolistic welfare analyses depending on the following externally assumed scenario data:

For model development, we used the game theory-based Cournot approach, including the cross-price elasticity of demand, as

The model is formulated as a Mixed Complementarity Problem (MCP). It provides a general mathematical framework that is particularly well suited to modelling energy markets: the equations that dominate the equilibrium in those markets are determined by Karush-Kuhn-Tucker (KKT, which set the conditions for profit maximisation) and market clearing conditions (supply equal to demand), plus the conditions that imply other constraints (such as emission limits, renewable energy targets, capacity limits et cetera).

This research project for the European Commission's DG JRC-IPTS developed a comparative static model of the electricity markets of seven EU Member States (Portugal, Spain, France, Germany, Belgium, the Netherlands, and Luxembourg). It considered cross-border connections between these countries.

The model can be used to perform oligopolistic welfare analyses depending on the following externally assumed scenario data:

- The capacity of the installed power plant.

- The availability/capacity factors.

- The fuel prices that vary from country to country.

- The share of bilateral/direct electricity trade.

- The international transmission capacities and tariffs.

- The mergers and acquisitions (including the splitting of companies).

- The support for renewable electricity (namely feed-in tariffs and green certificate markets).

- The targets for renewable electricity.

- The emission limits.

For model development, we used the game theory-based Cournot approach, including the cross-price elasticity of demand, as

- agents in this market adjust their output in response to the actions of other agents,

- this methodology can achieve more plausible and realistic results in terms of quantities and prices than other modelling alternatives, and

- this approach can represent a wide range of market structures from fully competitive markets to oligopolies and cartels.

The model is formulated as a Mixed Complementarity Problem (MCP). It provides a general mathematical framework that is particularly well suited to modelling energy markets: the equations that dominate the equilibrium in those markets are determined by Karush-Kuhn-Tucker (KKT, which set the conditions for profit maximisation) and market clearing conditions (supply equal to demand), plus the conditions that imply other constraints (such as emission limits, renewable energy targets, capacity limits et cetera).