Shifting from Labour Taxation to Road Pricing

15092

From 2016 to 2017

In collaboration with KU Leuven, this study examined how a green tax shift at the Flemish level could stimulate the economy while greening it. TML developed several scenarios for road pricing, calculated the direct and indirect effects, and prepared a full cost-benefit analysis to evaluate the potential impact on traffic volumes and the environment.

We studied the possibilities of implementing a green tax shift based on road pricing. For several years, Flanders has been striving to shift the burden on labour to taxes on environmental pollution, according to the principle 'polluter pays'. But until today, our country has the highest tax on labour in the European Union, except for France, and we are limping behind in terms of green taxes.

Road pricing is the tool of choice to change this. A charge of 0.07 euro per kilometre on average (with or without a higher rate during rush hour) would raise 3.3 billion euro annually, and a charge of 0.125 even up to 5.6 billion. Subtract the current revenue from traffic taxes - which would be abolished - and system costs, and €3.8 billion remains in the latter scenario. On top of this there would be 700 million in expected payback effects, due to the positive impact of the burden reduction on the economy and the labour market. Thus, Flanders will gain €4.5 billion, with which it can finance the green tax shift.

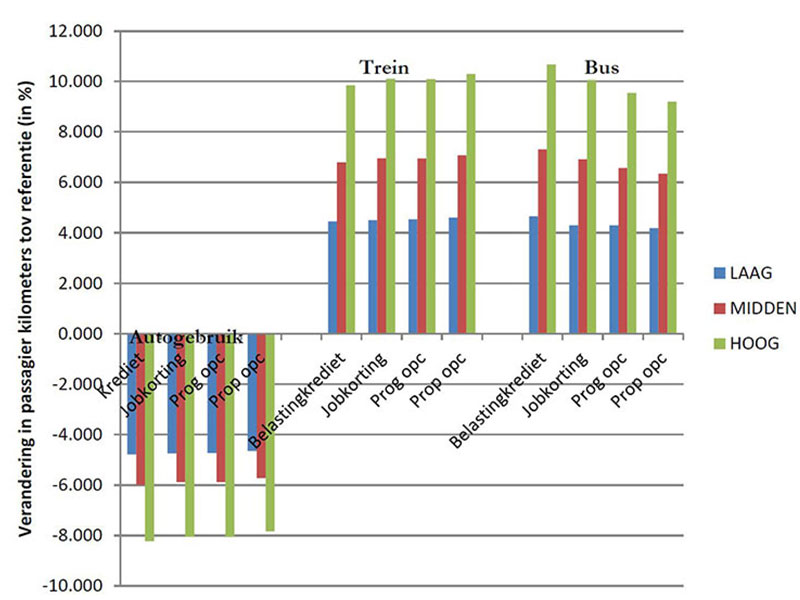

While car driving will become more expensive - by an average of 12 to 27 per cent compared to now - drivers would see this offset by the lower personal income tax. Moreover, as a result of road pricing, traffic will decrease, by 5 per cent at the lowest rate to 8 per cent at the highest rate. The resulting time savings on the road account for 347 to 592 million in economic gains.

We also expect CO₂ emissions to fall by 5 to 8 per cent. The drop in NO2 and particulate emissions would be even higher, especially if the charge favours low-emission vehicles. All in all, the introduction of a kilometre charge increases general welfare in Flanders.

Flemish Mobility Minister Ben Weyts (N-VA) points out that road pricing cannot be introduced at the snap of a finger. The aim is to have the dossier ready for decision before the government takes office in 2019.

In this study, TML drew up scenarios with a number of modes of road pricing. A total of five scenarios were used for the differentiation of road pricing. We also calculated the direct effects of these scenarios. Direct effects refer to impacts on traffic volumes (and congestion) and environmental impacts.

The indirect effects were then calculated and a full SCBA was drawn up, supplemented by a qualitative assessment of the aspects that cannot be captured in the SCBA. We supplemented this with reflections on flanking policies, including those related to public transport and the mobility budget.

This study was conducted together with KU Leuven, who supported us in calculating the indirect effects.